Bolivia as a Strategic Ally of the United States

The return of Donald Trump in 2025 redefines global geopolitics under a pragmatic and transactional logic. This scenario opens strategic opportunities for Bolivia through a selective rapprochement with the United States, with potential access to financing, investments, and cooperation, while preserving sovereignty and a diversified foreign policy.

The Social Impact of Economic Reforms

After the second round of elections, Bolivia faces a political transition in the context of macroeconomic deterioration. International projections anticipate low growth and high inflation, which requires structural reforms of subsidies and the exchange rate, accompanied by targeted social measures to preserve economic stability and social welfare.

Secure Financial Innovation

Fintech regulation in Bolivia and legislative advancements in cryptocurrency in the U.S. reflect a global convergence between innovation and financial oversight. ASFI’s ETF Regulation positions the country within this trend, strengthening legal security, driving financial inclusion, and mitigating risks associated with the rapid growth of cryptoassets.

The Cost of the Blockade

The “Agreement for the Common Good of Bolivia” reveals a political shift by recognizing the urgency of approving international loans, which had previously been deliberately blocked. Legislative paralysis has limited liquidity, investment, and macroeconomic stability, transferring the economic costs of political confrontation to the citizens.

Political Will in the Face of the Gray List

Bolivia’s inclusion in the FATF’s Gray List reflects regulatory shortcomings in the fight against money laundering and the financing of terrorism. The lack of legislative will threatens an eventual Black List, which would pose serious risks to the country’s financial stability, trade, and international reputation.

Green Light for Fintech

Supreme Decree No. 5384 establishes a regulatory framework for Fintech in Bolivia, strengthening legal certainty and financial oversight. This regulation facilitates innovation, promotes financial inclusion, and creates conditions for the entry of international players and the development of local ventures, directly benefiting users.

Spontaneous Industrialization

The proposals to abandon the industrialization model underestimate its complexity and the historical role of the state in economic development. International evidence shows that industrialization requires strategic and sustained public policies. In Bolivia, interrupting the current process would lead to setbacks in production and greater dependence on raw materials.

Credit Constraints in Bolivia

Credit restrictions limit investment and economic growth. In Bolivia, the legislative blockage of credit approvals has created a liquidity shortage that weakens the execution of public policies, affects macroeconomic stability, and hampers development. Overcoming this situation requires political consensus and responsible financing.

Transformation of Ideas into Projects

The creation of the FONDO STARTUP strengthens the Bolivian entrepreneurial ecosystem through venture capital aimed at innovative startups in exports and import substitution. This state initiative promotes innovation, productive diversification, and job creation by facilitating financing, strategic support, and sustainable growth.

Boosting Credit Guarantee Funds

In 2024, the Bolivian financial system consolidated the growth of productive credit and social housing, driven by regulated interest rates and guarantee funds such as FOGACP and FOGAVISP. These instruments strengthen access to financing, stimulate strategic sectors, promote employment, and contribute to economic and social development.

Beyond QR Transfers

In 2024, the Bolivian financial system experienced a significant digital advancement, with growing interbank electronic transactions and the predominance of QR payments. This transformation drives financial inclusion, efficiency, and competitiveness, aligns the country with global trends, and strengthens the sector’s resilience, highlighting the importance of technological investment and cybersecurity.

Cryptoassets in the Public Sector

Supreme Decree No. 5301 allows Bolivian public entities to operate with crypto assets, boosting financial efficiency and flexibility. Since the lifting of the prohibition, transactions and adoption of crypto assets have grown significantly. This measure positions the country within global trends, optimizing costs, security, and access to new financial opportunities.

The Bridge Between Banks and Social Function

Law No. 393 establishes that Bolivian financial entities allocate a portion of their profits to social purposes. This constitutional policy promotes financial inclusion, access to housing, and productive credit, balancing profitability with social well-being, positioning Bolivia as a leader in sustainable development and financial responsibility.

How to Reform the Hydrocarbon Subsidy in Bolivia

The gradual elimination of hydrocarbon subsidies in Bolivia requires lessons from Ghana, Indonesia, and Jordan: coordination with key stakeholders, phased implementation, and targeted compensations. These measures can improve fiscal and economic efficiency, protect vulnerable sectors, and reduce social tensions, ensuring a sustainable and balanced transition.

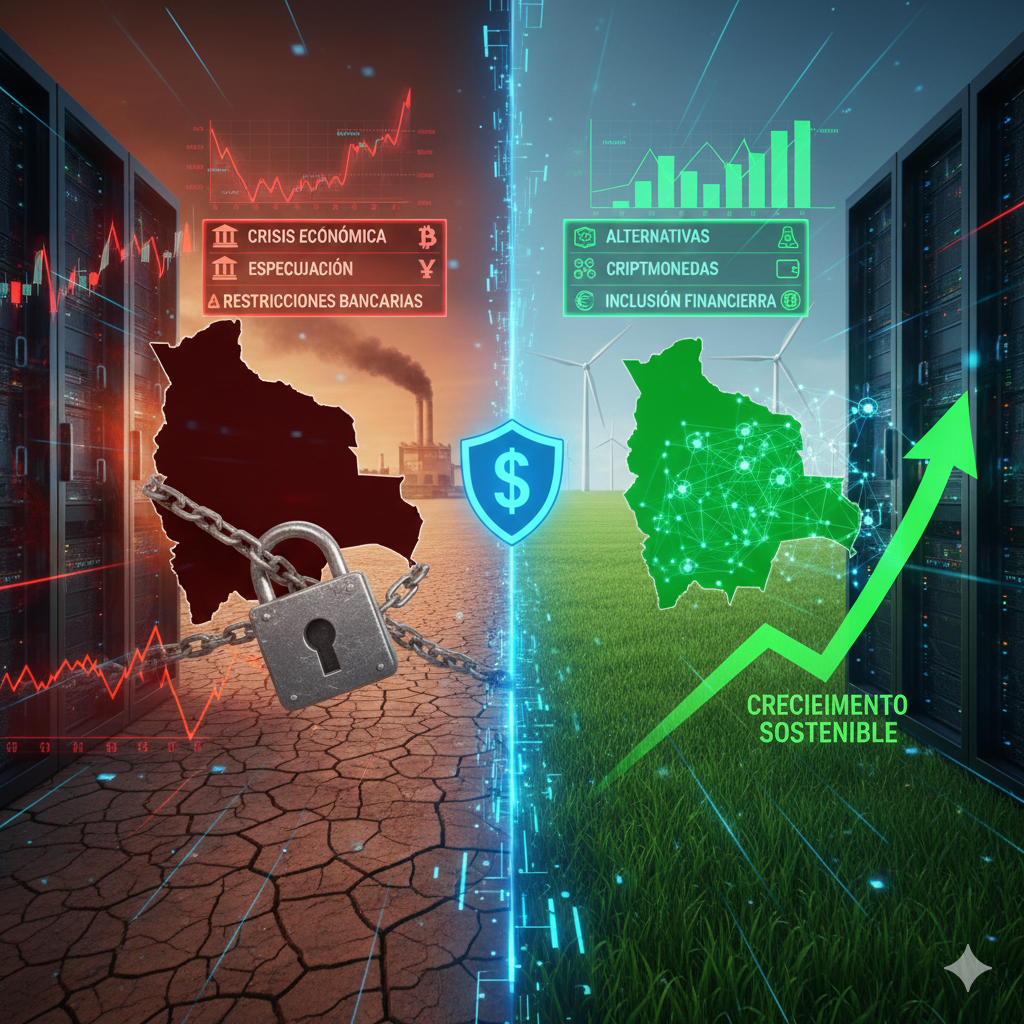

Cryptocurrencies: An Alternative in Times of Crisis and Restrictions

The lifting of restrictions on cryptocurrencies in Bolivia offers an alternative to currency speculation and facilitates international transactions with lower costs. Stable cryptocurrencies provide security, while education and oversight of financial entities are essential to mitigate risks and ensure safe, inclusive, and efficient use.

I Believe You

International Women’s Day reminds us of the historical struggle for equality and freedom. Gender-based violence remains a serious issue in Bolivia, with an increase in reports of sexual abuse. Recent cases, such as the “Confesionario UCB” incident, highlight the problem and strengthen movements like #IBelieveYou.

Oversimplifying the Health Crisis

The health crisis in Bolivia cannot be resolved solely by building hospitals; it requires comprehensive planning, provision of equipment, and training of specialists. The shortage of trained medical personnel and intensive care units highlights that investment in infrastructure must be complemented by specialization programs and strengthening the healthcare system.

Borrower Snapshot

The Central Bank of Bolivia returned $351.5 million to the IMF, correcting irregularities in the loan granted by the Añez government, which caused losses due to interest and non-compliance with legal procedures. The repayment aims to remedy economic damage, ensure regulatory compliance, and prevent misappropriation of public funds, ensuring transparency in state financial management.

The Maritime Claim and the Economy

Bolivia’s maritime claim faces economic and political complexities. The port of Ilo offers only the land, involving high construction costs and dependence on Peru. A strategic alternative is the bioceanic train, which would connect the Pacific and Atlantic Oceans, potentially strengthening Bolivian trade and putting pressure on Chile to reconsider its trade policy.