Cryptocurrencies: An Alternative in Times of Crisis and Banking Restrictions

Cryptocurrencies, commonly known as “digital money,” have gained significant relevance in recent years due to their growing acceptance as a medium of exchange in trade. This phenomenon has driven economies worldwide to adapt to them and integrate these new forms of money.

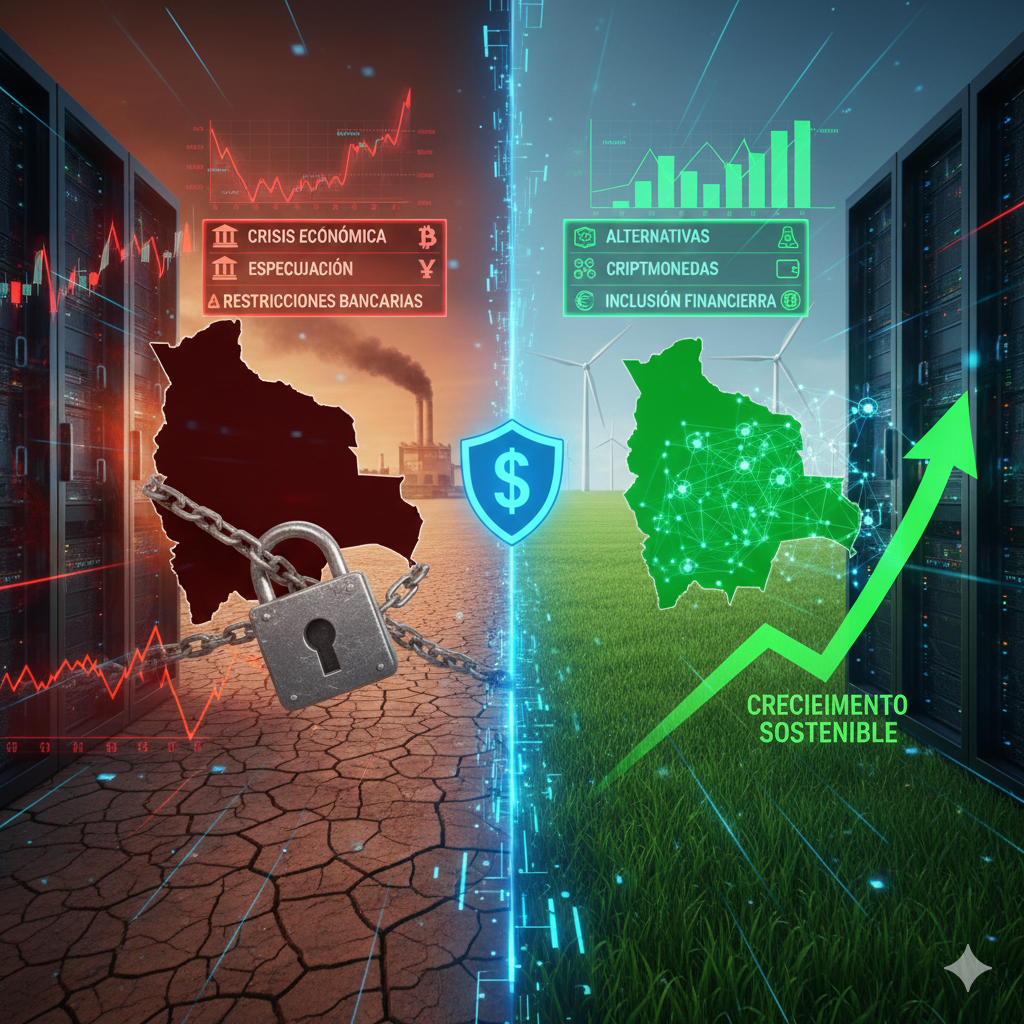

Bolivia is no exception, and amid an economic context marked by speculation and banking restrictions, the recent lifting of the regulation prohibiting the buying and selling of cryptocurrencies in our country represents a significant opportunity for the population. With the speculation of foreign currencies severely affecting economic activities, cryptocurrencies emerge as a viable alternative.

In this context, it is important to highlight two key aspects of cryptocurrencies. First, their utility against foreign currency speculation, primarily caused by the significant reduction of resources due to the subsidy on hydrocarbons, the lack of credit approval in the assembly, and road blockages for political reasons that disrupt the economic flow. These factors have made obtaining foreign currency increasingly difficult and costly.

In this environment of uncertainty, “stablecoins” present themselves as a safe option, unlike “volatile cryptocurrencies” such as Bitcoin, whose value can change drastically in minutes. Stablecoins, linked to fixed-value assets, commodities, or strong currencies, maintain a constant value, which facilitates large transactions such as purchasing real estate or vehicles.

The second aspect is the growing acceptance of cryptocurrencies in international trade. Bolivian importers and entrepreneurs, facing difficulties in accessing foreign currencies or only being able to obtain them at exorbitant prices, find in cryptocurrencies a practical solution. Not only are they easily convertible into other currencies, but their use and transfer also involve low fees, making them even more attractive.

Globally, more and more companies and individuals are adopting cryptocurrencies as a legitimate form of transaction, which clearly reflects their growing acceptance. This trend not only demonstrates the trust cryptocurrencies are gaining as a medium of exchange, but also their potential to transform the global financial system. It is expected that in the coming years, this adoption will continue to rise, driven by the constant digitalization of the economy and the search for more efficient and secure alternatives to conduct transactions worldwide.

The use of cryptocurrencies and related technologies has advanced rapidly, and our country has taken an important step by lifting restrictions on their commercialization. However, along with these opportunities come risks, as there has been an increase in the number of “experts” in cryptocurrencies and companies that, under the guise of offering specialized services, seek to exploit the situation for financial gain.

Therefore, active participation from regulatory bodies such as the Financial System Supervisory Authority, the Financial Investigation Unit, and the Central Bank of Bolivia is essential. The latter has positively started an educational plan to inform the public about the proper use of cryptocurrencies through workshops, publications, videos, and other strategies. This educational effort is crucial to ensure that the adoption of cryptocurrencies is done safely and beneficially for all Bolivians.

Author: Walter Marañon Quiñones